Corporate America Is Starting To Shy Away From Woke Business As Backlash Mounts

American companies are reversing the multiyear trend of hiring more employees in roles related to environmental, social and corporate governance (ESG) issues in an effort to increase profitability and address investor pushback, according to The Wall Street Journal.

U.S. companies shed 3,071 employees with positions related to ESG in December while only adding 2,897, continuing the trend that has been seen in half of the months in the last year of a net loss of ESG positions, according to the WSJ. The shift is in response to investors pulling their funds from companies heavily involved in ESG practices and placing their money in firms where they can get higher returns.

“2023 saw a real cooling in chatter around ESG and in some quarters, quite a pronounced attack on what ESG was about,” Joe Dubbin, managing director at executive search firm Cripps Leadership Advisors, told the WSJ. “It has certainly filtered through into the hiring requirements that we’ve been tasked to go do.”

Companies hired 40,884 ESG-related employees in 2023 while 39,452 departed, far different from 2022, when over 66,000 were hired and around 55,000 departed, according to the WSJ. Hires peaked in 2021 at over 68,000, with 49,383 people leaving.

Companies with the largest reductions in ESG employees in 2023 included Facebook parent Meta, Amazon and Google, according to the WSJ. More broadly, the technology, financial services and consulting sectors had the most outflows.

ESG funds lost around $2.7 billion in the third quarter of 2023, leading to more ESG funds closing than opening. The withdrawals from ESG funds in the third quarter marked the fourth straight quarter of outflows.

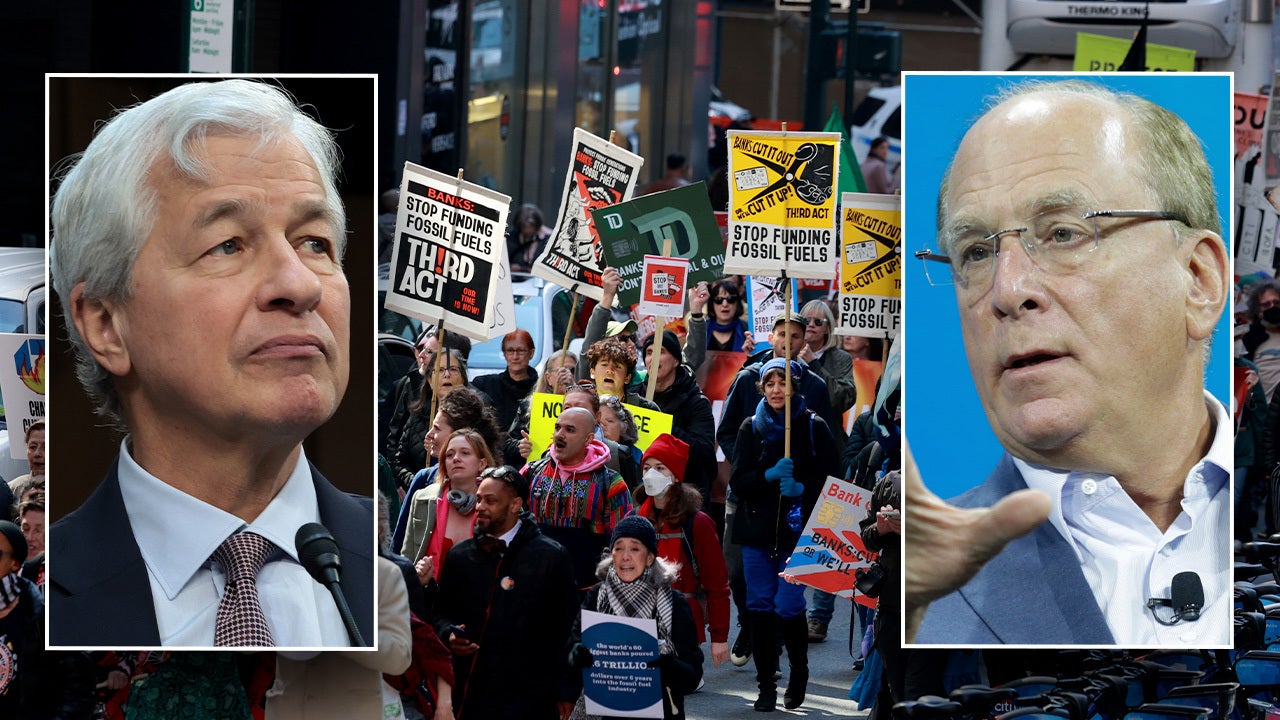

Top asset managers are facing legal pressure from congressional oversight, with Ohio Republican Rep. Jim Jordan sending subpoenas to Vanguard, Arjuna Capital, BlackRock and State Street Global Advisors in December seeking documents as a part of an antitrust investigation about ESG collusion. The investigation began in December 2022, when claims were made by congressional officials that asset managers were forming a “cartel” to bring down corporate greenhouse gas emissions.

Republican Florida Gov. Ron DeSantis signed legislation in May 2023 prohibiting state and local governments from considering ESG factors when issuing bonds in an effort to stymie financial institutions from discriminating against customers on the basis of political, religious or social ideology. DeSantis also led an 18-state alliance in March 2023 against ESG, calling for states to follow Florida in banning certain practices.

“You’re going to have to figure out what’s the language you’re going to use to stay in compliance, but also continue to do business with your biggest customers asking you for sustainability, carbon data or ESG data,” Mike Wallace, chief decarbonization officer at carbon accounting firm Persefoni, told the WSJ.

American companies are reversing the multiyear trend of hiring more employees in roles related to environmental, social and corporate governance (ESG) issues in an effort to increase profitability and address investor pushback, according to The Wall Street Journal.

U.S. companies shed 3,071 employees with positions related to ESG in December while only adding 2,897, continuing the trend that has been seen in half of the months in the last year of a net loss of ESG positions, according to the WSJ. The shift is in response to investors pulling their funds from companies heavily involved in ESG practices and placing their money in firms where they can get higher returns.

“2023 saw a real cooling in chatter around ESG and in some quarters, quite a pronounced attack on what ESG was about,” Joe Dubbin, managing director at executive search firm Cripps Leadership Advisors, told the WSJ. “It has certainly filtered through into the hiring requirements that we’ve been tasked to go do.”

Companies hired 40,884 ESG-related employees in 2023 while 39,452 departed, far different from 2022, when over 66,000 were hired and around 55,000 departed, according to the WSJ. Hires peaked in 2021 at over 68,000, with 49,383 people leaving.

Companies with the largest reductions in ESG employees in 2023 included Facebook parent Meta, Amazon and Google, according to the WSJ. More broadly, the technology, financial services and consulting sectors had the most outflows.

ESG funds lost around $2.7 billion in the third quarter of 2023, leading to more ESG funds closing than opening. The withdrawals from ESG funds in the third quarter marked the fourth straight quarter of outflows.

Top asset managers are facing legal pressure from congressional oversight, with Ohio Republican Rep. Jim Jordan sending subpoenas to Vanguard, Arjuna Capital, BlackRock and State Street Global Advisors in December seeking documents as a part of an antitrust investigation about ESG collusion. The investigation began in December 2022, when claims were made by congressional officials that asset managers were forming a “cartel” to bring down corporate greenhouse gas emissions.

Republican Florida Gov. Ron DeSantis signed legislation in May 2023 prohibiting state and local governments from considering ESG factors when issuing bonds in an effort to stymie financial institutions from discriminating against customers on the basis of political, religious or social ideology. DeSantis also led an 18-state alliance in March 2023 against ESG, calling for states to follow Florida in banning certain practices.

“You’re going to have to figure out what’s the language you’re going to use to stay in compliance, but also continue to do business with your biggest customers asking you for sustainability, carbon data or ESG data,” Mike Wallace, chief decarbonization officer at carbon accounting firm Persefoni, told the WSJ.