China Central Bank Orders Lenders To "Tolerate" Higher Bad Debt Levels To Avoid Financial Cataclysm

by

Tyler Durden

Zero Hedge

Sunday, 02/16/2020 - 20:30

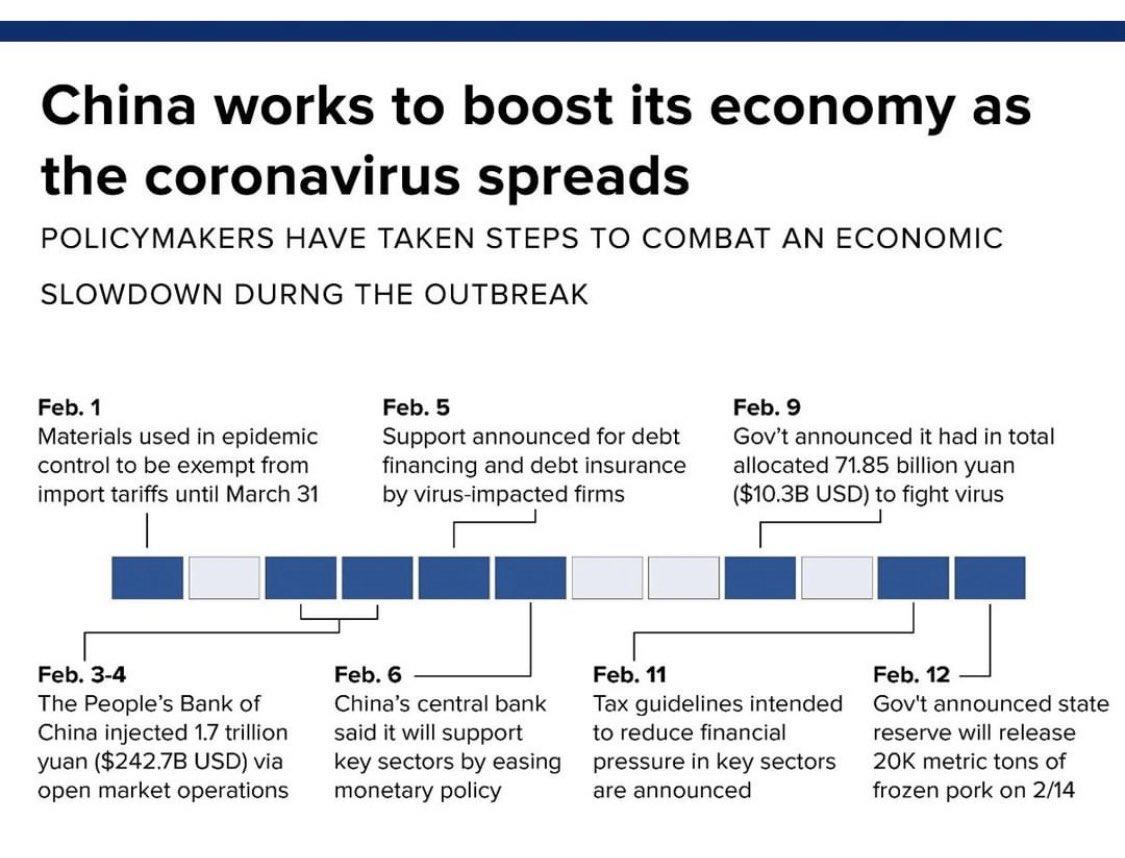

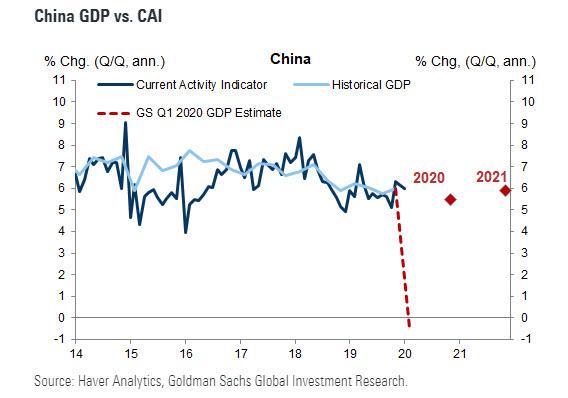

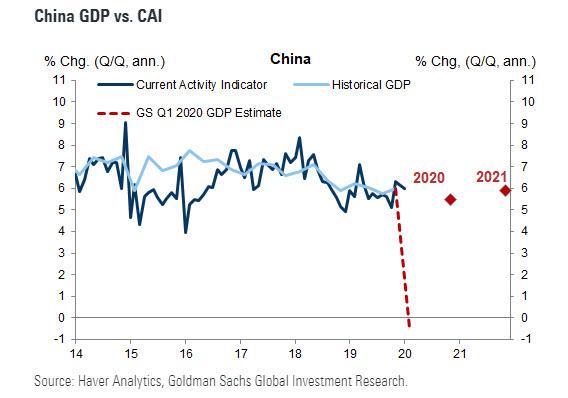

Last week we reminded readers that unless Beijing manages to contain the coronavirus epidemic, China faces a fate far worse than just reported its first ever 0% (or negative) GDP print in history. For those who missed it, here it is again: back in November, we reported that as part of a stress test conducted by China's central bank in the first half of 2019, 30 medium- and large-sized banks were tested; In the base-case scenario,

assuming GDP growth dropped to 5.3% - nine out of 30 major banks failed and saw their capital adequacy ratio drop to 13.47% from 14.43%. In the worst-case scenario, assuming GDP growth dropped to 4.15%, some 2% below the latest official GDP print, more than half of China's banks, or 17 out of the 30 major banks failed the test. Needless to say, the implications for a Chinese financial system - whose size is roughly $41 trillion - having over $20 trillion in "problematic" bank assets, would be dire.

Well, with GDP set to print negative if Goldman is right (with risk clearly to the downside as China's economy remains completely

paralyzed)...

... every single Chinese bank is set to fail a "hypothetical" stress test, and the immediate result is an exponential surge in bad debt. The result, as we discussed in detail last week, is that the bad loan ratio at the nation's 30 biggest banks would soar at least five-fold, and potentially far, far more, flooding the country with trillions in non-performing loans, and unleashing a tsunami of bank defaults.

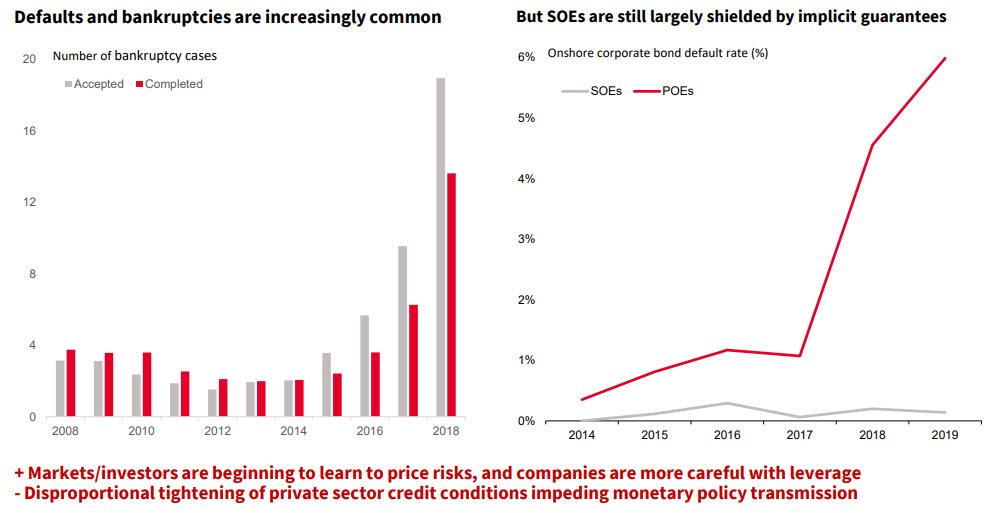

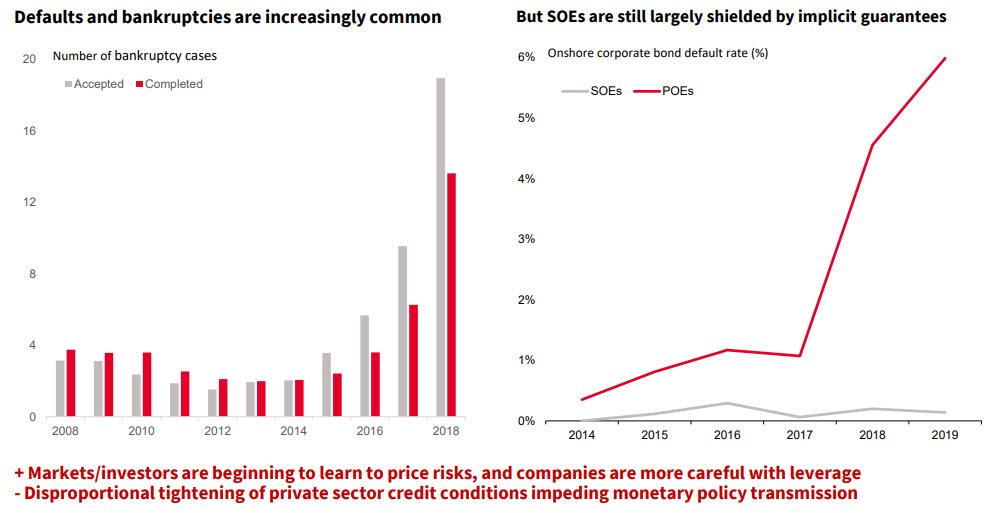

Of course, regular readers are well aware that China's banks are already suffering record loan defaults as the economy last year expanded at the slowest pace in three decades while bankruptcies soared. As extensively covered here previously, the slump tore through the nation’s $41 trillion banking system, forcing not only the first bank seizure in two decades

as Baoshang Bank was nationalized , but also bailouts at

Bank of Jinzhou, China'

s Heng Feng Bank, as well as two very troubling bank runs at China's Henan Yichuan Rural Commercial Bank at the start of the month, and then more recently at Yingkou Coastal Bank.

All that may be a walk in the park compared to what is coming next.

"The banking industry is taking a big hit," You Chun, a Shanghai-based analyst at National Institution for Finance &

Development told Bloomberg. "

The outbreak has already damaged China’s most vibrant small businesses and if it prolongs, many firms will go under and be unable to repay their loans."

According to a recent

Bloomberg report, S&P estimates that a worst-case scenario (one which however saw GDP remain well in positive territory) would cause bad debt to balloon by 5.6 trillion yuan ($800 billion), for an NPL ratio of about 6.3%, adding to the already daunting 2.4 trillion yuan of non-performing loans China’s banks are sitting on (a number which, like the details of the viral epidemic, is largely massaged lower and the real number is far higher according to even conservative skeptics).

S&P also expects that banks with operations concentrated in Hubei province and its capital city of Wuhan, the epicenter and the region worst hit by the virus, will likely see the greatest increase in problem loans.

The region had 4.6 trillion yuan of outstanding loans held by 160 local and foreign banks at the end of 2018, with more than half in Wuhan. The five big state banks had 2.6 trillion yuan of exposure in the region, followed by 78 local rural lenders, according to official data.

Meanwhile, exposing the plight of small bushiness, most of which are indebted to China's banks,

a recent nationwide survey showed that about 30% said they expect to see revenue plunge more than 50% this year because of the virus and 85% said they are unable to maintain operations for more than three months with cash currently available. Perhaps they were exaggerating in hopes of garnering enough sympathy from Beijing for a blanket bailout; or perhaps they were just telling the truth.

Finally, the market is increasingly worried that all this bad debt will have a dire impact on bank

assets: consider that the “big four” state-owned lenders, which together control more than $14 trillion of assets, currently trade at an average 0.6 times their forecast book value, near a record low.

This also means that in the eyes of the market, as much as $6 trillion in bank assets are currently worthless.

All of this led us to conclude last week that "

nothing short of a coronavirus cataclysm faces both China's banks and small businesses if the coronavirus isn't contained in the coming weeks."

In retrospect, there is one thing we forgot to footnote, and that is that China could buy some extra time if the central bank suspend financial rules and moves the goalposts once again.

And so, just three days after our first article on China's looming bad debt catastrophe, that's precisely what the PBOC has opted to do, because as Reuters writes, on Saturday

the PBOC said that the country's lenders will tolerate higher levels of bad loans, part of efforts to support firms hit by the coronavirus epidemic.

"We will support qualified firms so that they can resume work and production as soon as possible, helping maintain stable operations of the economy and minimizing the epidemic's impact," Fan Yifei, a vice governor at the People's Bank of China, told a news conference.

He added that the problem will be manageable as China has a relatively low bad loan ratio.

What the PBOC really means is that China's zombie companies are about to take zombification to a preciously unseen level, as neither the central bank nor its SOE-commercial bank proxies will demand cash payments amounting to billions if not trillions of dollars from debtors, who will plead "

force majeure" as part of their debt default explanation. In other words, we may be about to see the biggest "under the table" debt jubilee in history, as thousands of companies are absolved from the consequences of having too much debt.

Separately, during the same briefing, Liang Tao, vice chairman of the China Banking and Insurance Regulatory Commission, said that lending for key investment projects will be sped up, while Xuan Changneng, vice head of the country's foreign exchange regulator, said China was expected to maintain a small current account surplus and keep a basic balance in international payments. We wouldn't hold our breath for a surplus if China is indeed producing nothing as real-time indicators suggest.

And just so the message that

debt will flow no matter what is heard loud and clear, on Friday, said Liang Tao, vice-chairman of the China Banking and Insurance Regulatory Commission said that financial institutions in the banking sector had provided more than 537 billion yuan ($77 billion) in credit to fight against the novel coronavirus outbreak as of noon on Friday.

"The regulator will soon launch more measures to give stronger credit support to various industries," said Liang at a news conference held by the State Council Information Office on Saturday. "It will continue to lead banks' efforts on increasing loans to small and micro enterprises, making loans accessible to a larger number of small businesses, and further lowering their lending costs."

Hilariously, Liang highlighted the importance for banks to take accurate measures to renew loans for small businesses to reduce their financial pressure. It wasn't clear just how burdening the small businesses with even more debt they will never be able to repay reduces financial pressure, but we can only assume that this is what is known as financial strategy with Chinese characteristics.

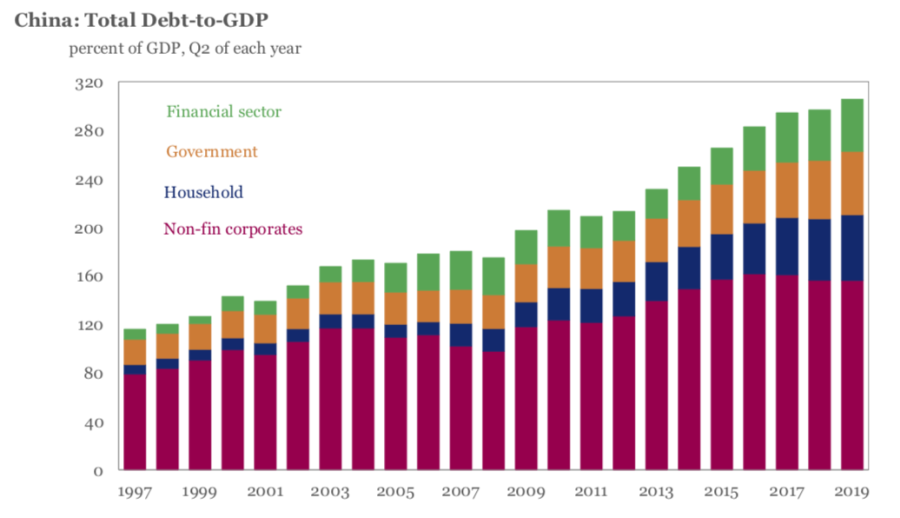

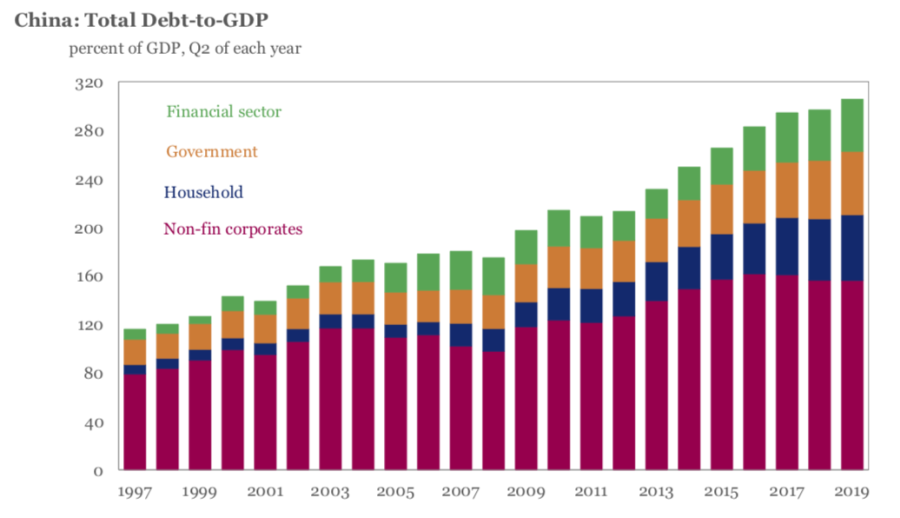

The bottom line is simple: no matter how or when the coronavirus epidemic ends, the outcome for China - which already toils under an gargantuan 300% debt/GDP burden...

... will be devastating as more companies are encumbered by even more debt which they will never be able to repay, and once rates jump or the Chinese economy hits another pothole - viral or otherwise - the avalanche in defaults will be a sight to behold.

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

www.zerohedge.com