You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

VIDEO ECON: Jim Sinclair-Silver Will Be Gold On Steroids In Coming Rally

- Thread starter Hacker

- Start date

almost ready

Inactive

Hi, Hacker. Am listening to this now. Interesting!

JohnGaltfla

#NeverTrump

Low range for me is $10-$14 per oz. High range? Anything above $40 per oz.

knowzone

Veteran Member

Low range for me is $10-$14 per oz. High range? Anything above $40 per oz.

16:1

$50,000/AU = $3,125/AG

of course gas will be $97.999 gallon then, but....?

kz

West

Senior

16:1

$50,000/AU = $3,125/AG

of course gas will be $97.999 gallon then, but....?

kz

How much for a horse/bail of hay or moped be then?

As a comparative point, back in the early 1960's, when silver coinage was still being minted in the USA, the price of gasoline was 3 silver dimes. Each dime had 0.071 ounces of silver, and 1 gallon cost 0.213 ounces of silver.

Today 0.213 ounces of silver priced in US$ is $3.09 - The proprtional relationship between the silver content in 3 pre 1965 dimes and a gallon of gas has held pretty true.

If Silver were to fetch $3,125 per ounce, I would guess that a gallon of gasoline will cost somewhere in the neighborhood of $665 +/-, and a loaf of bread will run you about $125.

Today 0.213 ounces of silver priced in US$ is $3.09 - The proprtional relationship between the silver content in 3 pre 1965 dimes and a gallon of gas has held pretty true.

If Silver were to fetch $3,125 per ounce, I would guess that a gallon of gasoline will cost somewhere in the neighborhood of $665 +/-, and a loaf of bread will run you about $125.

knowzone

Veteran Member

What?!

$3100 +/oz for silver sends everyone into meltdown but $50,000/gold blows by?

I personally don't believe we'll have enough "order" to transact these numbers for either metal.

However, based upon historical average, and, geological ratio, 16 ounces of silver to one ounce of gold, at $50,000/oz. for gold equates to $3,125/oz for silver.

kz

$3100 +/oz for silver sends everyone into meltdown but $50,000/gold blows by?

I personally don't believe we'll have enough "order" to transact these numbers for either metal.

However, based upon historical average, and, geological ratio, 16 ounces of silver to one ounce of gold, at $50,000/oz. for gold equates to $3,125/oz for silver.

kz

Earlier discussion today at http://www.timebomb2000.com/vb/show...-Team-is-Losing-Control-of-the-Markets..Crash

Knight_Loring

Veteran Member

Damn!!!

Just when my indicators all show silver is going to $8.50 per oz, I start seeing WILD ASS predictions on totally unattainable crazy price predictions for the future price.

Hopefully, the WILD ASS predictions will be contained to TB2K. As I am a true Contrarian.

I am all set to buy heavily starting at $9.00 and will have a greatly enriched future...

BUT, if CRAZY price predictions become common, I will wait until the total washout at $3.50 per oz.

Where the hell is the prediction of $50,000 per AU oz coming from???

Yes 16:1 happens occasionally, but is no longer a normal ratio.

Hopefully, AG reaches $100.00 in 10 years.

Lets get our heads level folks.

Just when my indicators all show silver is going to $8.50 per oz, I start seeing WILD ASS predictions on totally unattainable crazy price predictions for the future price.

Hopefully, the WILD ASS predictions will be contained to TB2K. As I am a true Contrarian.

I am all set to buy heavily starting at $9.00 and will have a greatly enriched future...

BUT, if CRAZY price predictions become common, I will wait until the total washout at $3.50 per oz.

Where the hell is the prediction of $50,000 per AU oz coming from???

Yes 16:1 happens occasionally, but is no longer a normal ratio.

Hopefully, AG reaches $100.00 in 10 years.

Lets get our heads level folks.

Hfcomms

EN66iq

Lets get our heads level folks.

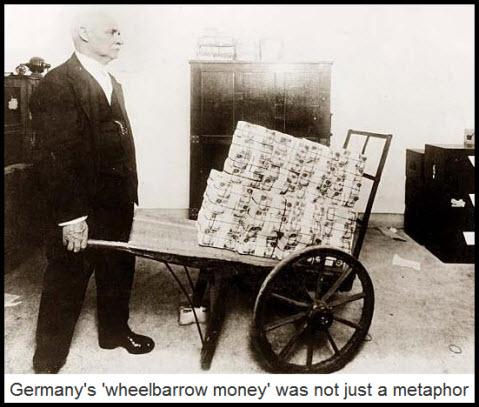

I think heads here are pretty level. Hyperinflation is a currency event. Central banks of the world are flooding the system with liquidity right now in a futile attempt to stave off deflation. The China central bank and the Fed are leading the way. The dollar appears 'strong' right now compared to others as we are still the reserve currency.

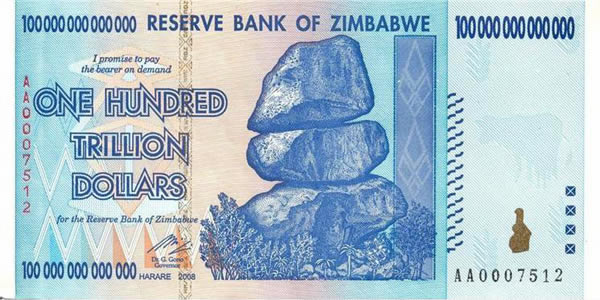

Eventually this deflation will turn into hyperinflation and the dollar will go into oblivion. I have a ten million Weimer Republic Rentenmark in my possession as well as Zimbabwe 100 trillion dollar notes. I intend to display these with a new $10000 Federal Reserve note in the future.

In a hyperinflation scenario $50000 gold could be very easy to obtain, just like a $100 loaf of bread. The thing is that 1 ounce gold coin valued at $50,000 will buy what it buys right now at $1,125 gold. The pricing in dollars will be immaterial. The inherent value of the metal doesn't change. It's the value of the $ going into the toilet.

West

Senior

I think heads here are pretty level. Hyperinflation is a currency event. Central banks of the world are flooding the system with liquidity right now in a futile attempt to stave off deflation. The China central bank and the Fed are leading the way. The dollar appears 'strong' right now compared to others as we are still the reserve currency.

Eventually this deflation will turn into hyperinflation and the dollar will go into oblivion. I have a ten million Weimer Republic Rentenmark in my possession as well as Zimbabwe 100 trillion dollar notes. I intend to display these with a new $10000 Federal Reserve note in the future.

In a hyperinflation scenario $50000 gold could be very easy to obtain, just like a $100 loaf of bread. The thing is that 1 ounce gold coin valued at $50,000 will buy what it buys right now at $1,125 gold. The pricing in dollars will be immaterial. The inherent value of the metal doesn't change. It's the value of the $ going into the toilet.

And if I had a few ounces of gold maples, AGEs, and nuggets, when it does go to $50k it would not be exchanged for FIAT!

Just saying,

West

Senior

Damn!!!

Just when my indicators all show silver is going to $8.50 per oz, I start seeing WILD ASS predictions on totally unattainable crazy price predictions for the future price.

Hopefully, the WILD ASS predictions will be contained to TB2K. As I am a true Contrarian.

I am all set to buy heavily starting at $9.00 and will have a greatly enriched future...

BUT, if CRAZY price predictions become common, I will wait until the total washout at $3.50 per oz.

Where the hell is the prediction of $50,000 per AU oz coming from???

Yes 16:1 happens occasionally, but is no longer a normal ratio.

Hopefully, AG reaches $100.00 in 10 years.

Lets get our heads level folks.

IMHO, and SWAG The paper price of silver might go to $10 a ounce, and you might be able to find 10 oz. bars for only a couple dollars over spot for each ounce, But 90% coin and even rounds will carry a premium keeping the real price of a silver ounce in your hand at around $20 a ounce.

You should start accumulating now. It's not going to get much cheaper.

I need to go buy a few rolls of silver dimes so I can pay off my house.

Last junk silver I saw was rolls of quarters that were going for $7.49 oz OVER silver spot price. Not much junk on the market right now.

almost ready

Inactive

Sinclair's most important comments have to do with the changes to society as a result of this. Well worth a listen. Sounds like this transcends regular shifts and that, perhaps, could be seen as the 200-year supercycle which was discussed about a decade ago.

Reminded me of it. Remember that book, The Great Wave? It certainly caused a lot of consternation in the financial and political worlds. Oxford University Press. The last decade and a half have been futile efforts to prevent the cycle from ending, but they might as well have been telling the tide not to come in.

The wheel of fortune has moved forward a notch. Sinclair confirms this. This is worth a listen. May listen again to be sure no nuances were missed.

Thanks for starting this thread, Hacker. You are a great poster for TB2K and one I never pass without a look.

Reminded me of it. Remember that book, The Great Wave? It certainly caused a lot of consternation in the financial and political worlds. Oxford University Press. The last decade and a half have been futile efforts to prevent the cycle from ending, but they might as well have been telling the tide not to come in.

The wheel of fortune has moved forward a notch. Sinclair confirms this. This is worth a listen. May listen again to be sure no nuances were missed.

Thanks for starting this thread, Hacker. You are a great poster for TB2K and one I never pass without a look.

Codeno

Veteran Member

What?!

$3100 +/oz for silver sends everyone into meltdown but $50,000/gold blows by?

I personally don't believe we'll have enough "order" to transact these numbers for either metal.

He believes that at the new highs as it rises, gold will become a valuation form rather than a currency and that those who hold it won't sell off the "rally".

Good interview.

Last edited: