bcingu

Senior Member

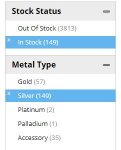

CNBC's Brian Sullivan discusses how silver inventories are selling out, in part because retail investors are buying up silver coins and bars, with Michael Wittmeyer, CEO of JM Bullion, an online precious metals dealer. Subscribe to CNBC Pro to access our live Pro Talk “How to Navigate the Reddit Market Mania” with Fundstrat’s Tom Lee and CNBC’s Mike Santoli: https://cnb.cx/3r7vPrJ The price of silver surged higher on Monday as the Reddit-fueled boom in highly shorted stocks appears to be spilling over into the metals market. Silver futures rose 8% to at $29.06 an ounce, marking the largest one-day pop in silver on NYMEX since at least 2013. The contracts traded 11% higher at $30.35 an ounce earlier in the day, the highest level since Feb. 15, 2013.

r/t 4:00

MSNBC interview of JM Bullion's CEO

r/t 4:00

MSNBC interview of JM Bullion's CEO