Hummm.................

Posted for fair use.......

You can’t choke a dead horse. Anyone who has studied geopolitics, particularly in the context of energy, has learned that control over waterways — most

warontherocks.com

RED SEA SHOCKS AND THE NEW MORE STABLE NORMAL

GREGORY BREW

FEBRUARY 23, 2024

COMMENTARY

You can’t choke a dead horse. Anyone who has

studied geopolitics, particularly in the

context of energy, has learned that

control over waterways —

most notably the Suez Canal — translates into influence, as actors can threaten to disrupt energy supplies. But they also know that leverage is limited: Commerce invariably adjusts to disruptions and markets stabilize around a new normal. The

crisis in the Red Sea demonstrates this effect, though in an unexpected way. Months of Houthi

attacks on shipping, followed by a significant U.S. and British military response, has done little to move oil prices, while the impact on supply has been negligible. Markets, in effect, shrugged off the Red Sea disruption.

This is indicative of a broader shift. The geopolitics of energy have undergone a transformation, call it “the great de-risking,” brought on by progressive geopolitical shocks and shifts in the sources of supply over the last decade. Risk still exists. But

dislocating events, compounded by the shift in oil production from the Persian Gulf to the Gulf of Mexico, have redrawn the energy map. Energy flows have now been forced into two distinct channels, centered on the Atlantic basin and Indo-Pacific region. These connect markets not just through commercial ties but through geopolitical relationships, improving the resilience of energy connections and, by extension, improving energy security in the midst of an expanding global energy transition.

Energy relationships that used to inject risk and volatility into the global economy — Europe’s dependence on Russia, or U.S. dependence on the Middle East — have now largely been replaced by relationships tying like-minded states together, through channels that largely avoid strategic chokepoints. The Red Sea crisis, rather than the beginning of a new era of instability, could mark such an era’s end, and the transition to a new — and perhaps more stable — normal.

The Crisis That Wasn’t

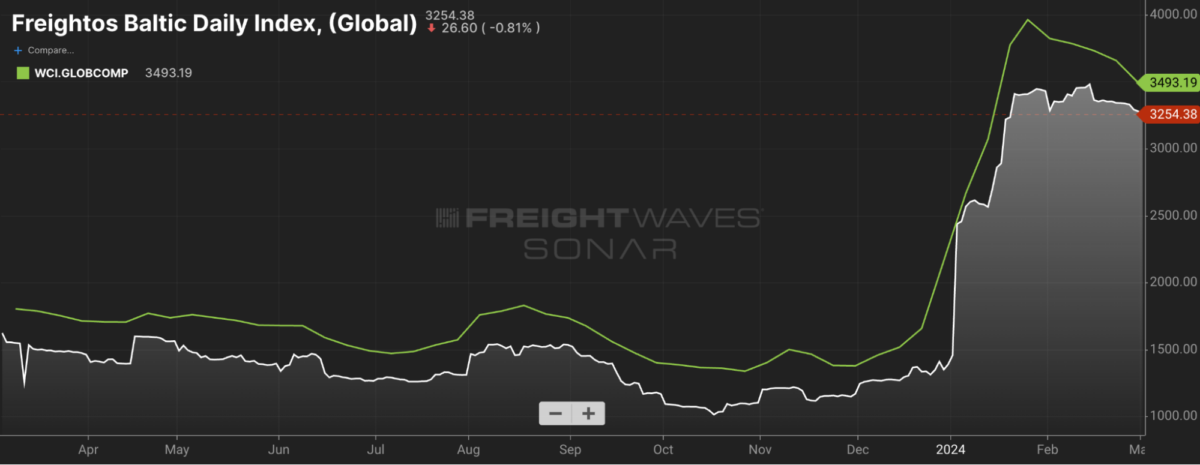

Though the Red Sea crisis

has disrupted the shipping of goods and increased costs for some companies, it has not produced a meaningful shock to energy prices or disrupted the available supply of energy products.

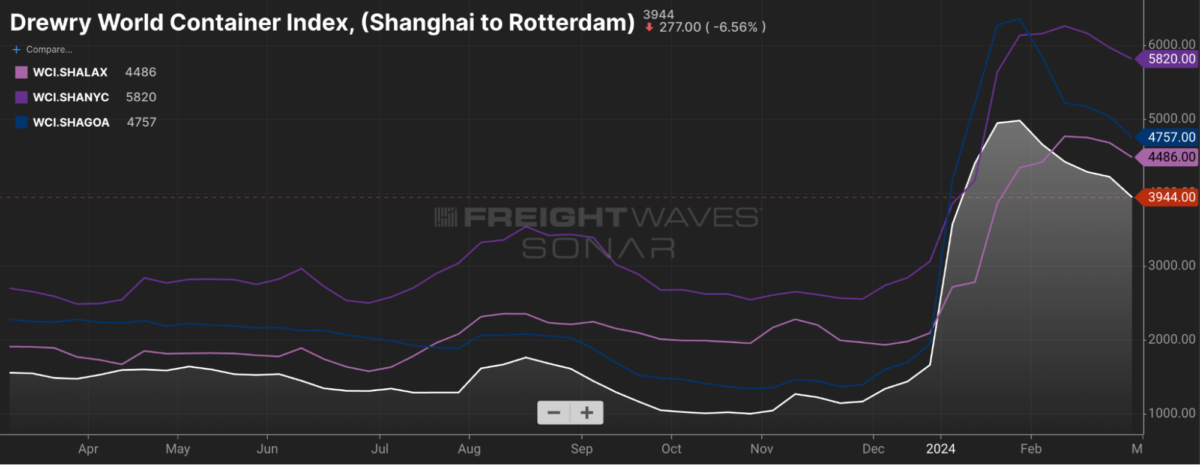

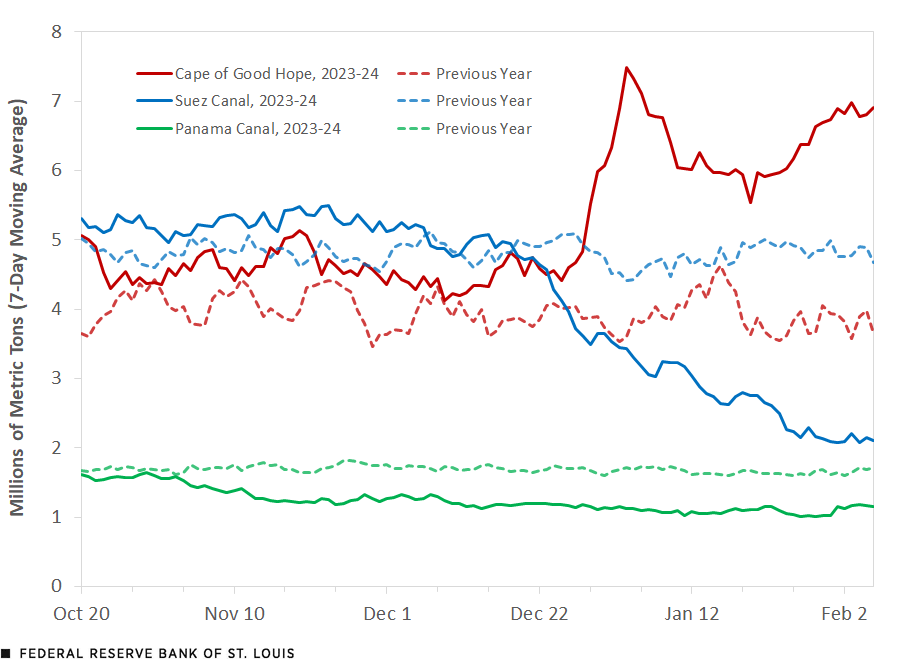

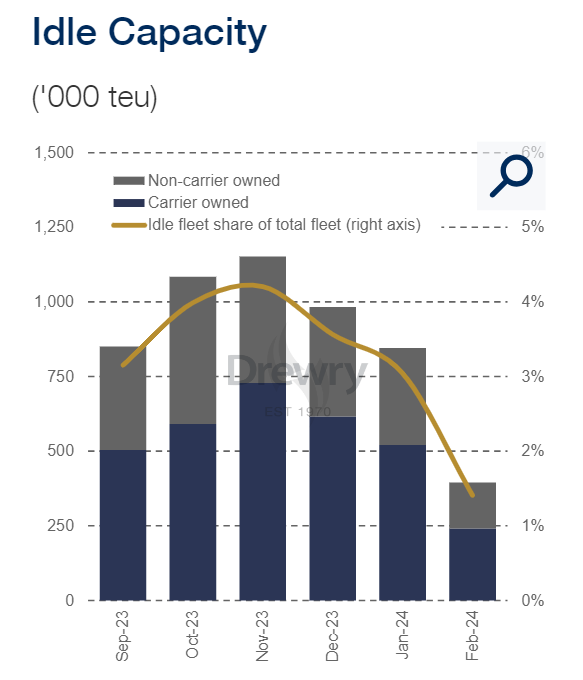

When the Houthis began attacking commercial maritime traffic in mid-December, the response from container shipping was near instantaneous. Within a month, three-quarters of container traffic was avoiding the Red Sea, opting for the longer, pricier, but safer route around Africa. Before long, however,

energy companies began to follow suit, though they did not do so in unison. While Middle East and Russian oil continued to transit the Red Sea, Western firms feared attack from the Houthis and opted for the Africa route — or, in some cases, chose different markets for their products. By February, tanker traffic through the Bab al-Mandeb had fallen by

roughly 50 percent.

Despite this, the reaction from oil markets — and from the energy industry in general — has been muted. There are several reasons for this. First, it’s important to note that while the Red Sea is a conduit for energy supplies, it is far from the most important. Crises in the Middle East are often presumed to affect oil, but most of the region’s energy flows out of the Persian Gulf and through the

Strait of Hormuz, an area which has remained outside the regional crisis.

Part of this is down to market dynamics. The Persian Gulf, which still accounts for

a third of global production and half of proven oil reserves, sends the majority of its supply east, to China and the energy-starved industrial economies of

northeast Asia. This channel, which accounts for a third of all the

seaborne oil trade in the world, is likely to become more important.

India and other emerging markets in the eastern hemisphere are expected to provide most of the world’s remaining oil demand growth, at least before the energy transition and market maturation bring peak oil demand at some point in the next 10 to 20 years. Middle East producers feel confidant that the Houthis

won’t target their ships, but they also don’t care as much about the Red Sea as much as, say, the Taiwan Strait.

The Superpower Producer

This shift in focus has been facilitated by developments west of Suez. During the energy shock of 1973, a historical moment that policymakers like to

connect to the present crisis, Middle Eastern energy was of pivotal economic importance to the economic life of the United States and western Europe. By the 21st century, however, the relative importance of the Middle East had declined: the United States now imports less Persian Gulf oil than it has in

30 years.

That connects to the real seismic shift in oil supply: the

rise (or, rather,

return) of the United States as an oil and gas exporter. The United States is now a

net exporter of oil liquids, a status it held before 1948. It is, in fact, producing more oil and gas than any nation in history. More importantly, it is an exporter that retains considerable upside —

potential for increased production into the future — which makes it an attractive long-term source. As a result, a crisis-prone world characterized by disruptions, deviations, and redirections in energy flows is also one where oil is, if anything,

more abundant than ever, thanks in part to

booming U.S. production.

China was the

biggest customer for American liquified natural gas before 2019. However, geopolitics pushed the U.S. supply into a new channel dominated by European consumers. Europe is determined to

wean itself off Russian energy in the wake of Vladimir Putin’s war in Ukraine. The presence of an energy titan across the Atlantic has given Europe, the world’s largest oil importing region after East Asia, a ready alternative to now-sanctioned Russia and the crisis-prone Middle East. The United States currently supplies

roughly 20 percent of the European Union’s crude oil, a figure that is likely to increase over time, and in 2023 it accounted for

half of the union’s liquified natural gas imports.

And the Superpower Consumer

The preferences of China, the

largest oil importer in the world, also helped drive these trends. Beijing values diversified supply. It also appears more comfortable buying from the Russians and the Middle Eastern producers than from the United States and Australia, formerly two of its major sources of liquified natural gas.

Iran is also an important source for China, as U.S. sanctions limit its ability to sell to any other customer. China takes more than 1 million barrels per day in discounted Iranian crude, a relationship that is unlikely to change any time soon, even as Tehran has begun

pushing for a better price.

Around the world, energy producers have adjusted to this new normal. Russia has lost its biggest market, and though it has lost the ability to export gas by pipeline, Russia continues to export oil at

roughly the same rate it did in 2021, albeit to very different customers. Thanks to geopolitical realities, Russian oil from the Baltic now

ends up in India. Commercially this doesn’t make much sense, since there are bigger consumer markets that are much closer, but it serves the interests of Russian companies as well as Indian consumers, who get to buy at a discount. Like the Middle East, Russia has little to fear from the Houthis, a geopolitical factor that allows Russian crude to flow east through the Suez Canal,

barring the occasional accident.

The Persian Gulf, meanwhile, is content to look east, rather than west, for its markets. Saudi Arabia has committed to massive investment sin China’s

downstream energy sector, locking in decades of oil demand. By accepting China’s help in

normalizing relations with Iran and increasing economic and security cooperation with Beijing, Saudi Arabia is signaling that it prioritizes a better relationship with its largest customer, even if it

isn’t ready to part ways with the United States.

Geopolitics, combined with the rise of the United States as a major energy exporter, have pushed energy flows into two distinct channels: one in the Atlantic basin, the other in Asia running through the Indo-Pacific. As with all energy systems, this one is unlikely to last forever. Europe is working hard to

reduce its oil and gas consumption, a trend that is also likely to hold true in the developed markets of Asia. Though the risks of disruption have declined as flows adjust to the new normal, risk still remains, owing in part to climate change effects like the droughts that are currently

disrupting flows through the Panama Canal. Disruptions can come through asymmetric attacks, such as cyber warfare, or through sabotage, as in the case of the

Nord Stream pipelines or the

Colonial pipeline in the United States.

Nevertheless, the effect of repeated crises in global energy supply chains has forced a de-risking of energy flows, based around geopolitical as well as commercial relationships. Formerly risk-heavy ties, such as Europe’s dependence on Russia or America’s dependence on the Middle East, don’t play as much of a role in the global energy economy as they once did.

Gregory Brew is a historian of oil, Iran, and the Cold War. He is currently an analyst for Eurasia Group where he covers Iran and the geopolitics of oil and gas.