Doomer Doug

TB Fanatic

Here is the link to a Zero Hedge article on the MASSIVE POWER BILLS LOOMING NATIONWIDE. People could be looking at monthly power bills MULTIPLE times higher than "normal," say SEVERAL hundred dollars for example. The utilities themselves will be dealing with large scale physical damage to infrastructure, like frozen valves etc.

On top of everything else we are dealing with, it is likely residential and commercial power bills may be SIGNIFICANTLY more costly when February's cold snap is factored in. may even break people financially, when combined with evictions, unpaid rent, and utilities etc

www.zerohedge.com

www.zerohedge.com

"Power Bills To The Moon": Chaos, Shock As Electricity Prices Across US Explode

BY TYLER DURDEN

SATURDAY, FEB 13, 2021 - 15:00

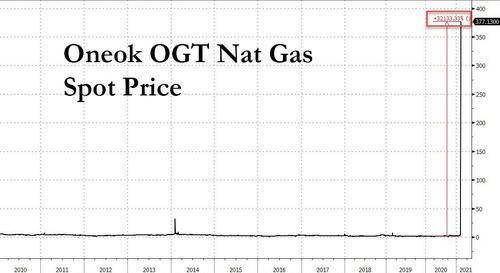

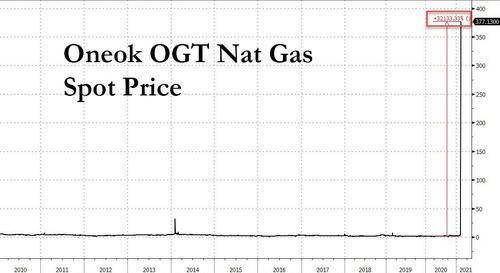

On Thursday, when we reported that nat gas prices across the plains states had soared to never before seen levels as a result of a brutal polar vortex blast...

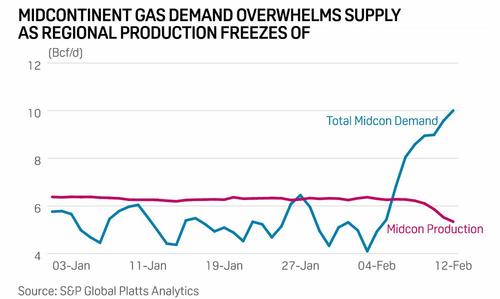

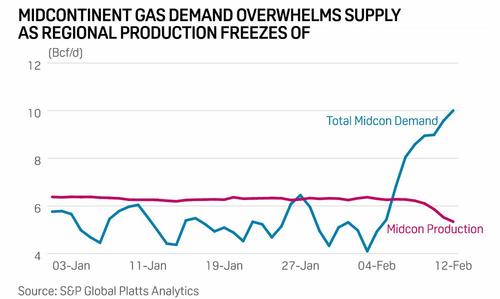

... which literally froze off nattie supply as wellheads freeze-offs, cutting production receipts just when they're most needed by customers' demand for heating, we said that since the winter blast is expected to last for the duration of the week, it is likely that nattie prices across the plains states could hit GME batshit levels.

One day later that's exactly what happened because as frigid temperatures caused equipment failures, temporarily shutdowns and flaring in at least four nat gas processing plants ...

Hubs across the Midcontinent led the surge in prices again Feb. 12 as weather forecasts predicted the coldest temperatures in more than a decade would hit the region over the upcoming holiday weekend. Platts reported that at locations across Kansas, Oklahoma and Eastern Arkansas, hub prices were trading at single-day record highs around $200 to $300/MMBtu. Regional hubs, which typically service only limited local demand, saw fierce competition among shippers, utilities and end-users looking to meet weekend requirements.

At one Enable Gas Transmission location, the cash market traded as high as $500 with weighted-average prices holding steady by mid-session around $359/MMBtu. At other nearby hubs, cash markets moved to dizzying, record highs with One Oak Oklahoma at $374 (chart above), Southern Star at $275, Panhandle at $225 and ANR Oklahoma at $205. At the region's benchmark location, NGPL Midcontinent, the market was holding around $205/MMBtu, data from the Intercontinental Exchange showed.

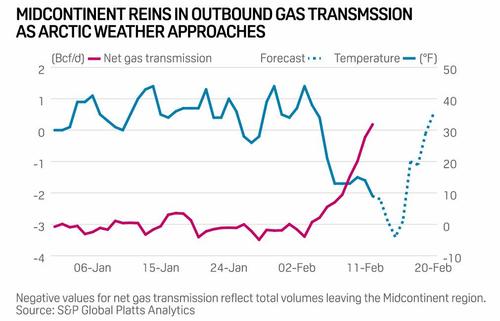

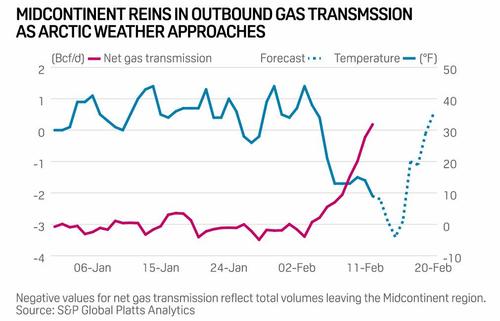

And as end-users across the Midcontinent compete for available gas, shippers moved quickly to cut transmissions to neighboring markets. On Feb. 12 net, inbound shipments of gas climbed to 180 MMcf/d – their highest on record dating back to 2005. In January, the Midcontinent region – which typically delivers gas to neighboring markets – saw net outbound transmissions average nearly 3.1 Bcf/d.

Of course, as natgas went offerless it was just a matter of hours before the immediate downstream commodity, electricity, would follow suit and that's precisely what happened overnight as wholesale electricity prices across all US markets on Friday.

Echoing what we said on Friday, Platts wrote that "as arctic air mass continues to blanket much of the central US, the US National Weather Service has issued multiple severe weather notices. Widespread wind chills warnings and advisories are extended through Feb. 14 and likely into the next week for much of the Upper Midwest and Midcontinent, as well as some areas in the Northwest and northern Texas. Daily temperatures across some of the locations will range between 30 to 40 degrees below average, according to the NWS. Eastern PJM, Northwest and much of Texas are also under winter storm warnings and winter weather advisories."

This is catastrophic news not only for the continued freeze in nat gas distribution, but for the explosion in electricity prices which could see many customers see a February electricity bill in the thousands, if not tens of thousands. This is what a power trader at a Houston energy company advised us on Friday:

What follows is a breakdown of how the nat gas supply collapse is impacting soaring electricity prices across the US, courtesy of Platts:

Texas

ERCOT next-day prices reached record highs on the Intercontinental Exchange as temperatures throughout Texas were forecast to tumble double digits on Feb. 15. Dallas temperatures were forecast to drop to 8 degrees Fahrenheit, and Houston was forecast down to 34 F, according to CustomWeather.

The brutally cold temperatures also affected wind supply in ERCOT, generation for Feb. 15 was forecast to tumble down 52.5% to 27.8 GWh of generation as cold temperatures impacted wind turbines. DeAnn Walker, chairman of the Public Utility Commission of Texas, said at a meeting on Feb. 11 that there were some "issues with some gas generation plants being curtailed" and that "wind turbines are all frozen," further placing upward pressure on already sky-high prices.

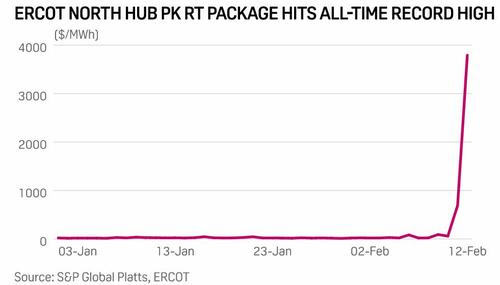

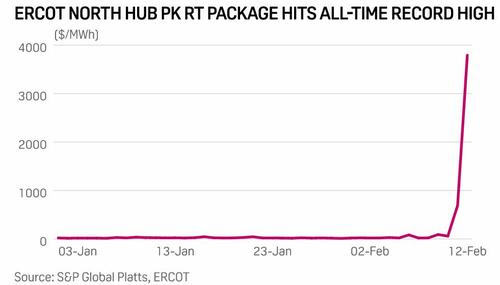

ERCOT North Hub real-time next-day Feb. 15 on-peak power prices skyrocketed to trade above $3000, up from its previous settlement of $325/MWh. Next-day prices broke high records, and they had not seen similar four-digit prices since Aug. 15 2019, when prices settled around $1848/MWh.

ERCOT North Hub real-time balance-of-the-week for Feb. 16 through Feb. 19 surged to top $1500/MWh, and the balance-of-the-month off-peak package for Feb. 16 through Feb. 28 climbed about $499.75 to trade at $650/MWh.

In response to the unprecedented scramble, the Texas oil/gas regulator, the RRC, approved emergency provisions, and warning that the deep freeze may have "severe impact" on energy supplies, said that power plants may struggle to acquire gas for generators.

Central

In the Midcontinent ISO, Indiana Hub on-peak jumped to its highest price since January 2019 to trade above $100/MWh. Bal-of the-week also rallied to price on par with the next-day flow package. As polar vortex continues to impact the region, the February-to-date average day-ahead price jumped almost 70% month on month and nearly doubled year on year. MISO demand forecast for Feb. 15 is the strongest since August 2020 at 98.63 GW.

As of Feb. 12, MISO is declaring conservative operations due to extremely cold temperatures and generator fuel supply risks through Feb. 16. All transmission and generation maintenance will be suspended in the affected areas, and all outages plans should be reviewed, according to the most recent grid operator's notice.

In PJM, AD Hub on-peak traded in the upper $70/MWh, rising double digits day on day. PJM West Hub also rose to trade in the mid-$60s/MWh. Power demand was forecast to begin retreating slightly in the upcoming days, however, it was still expected to remain relatively strong.

West

West power prices surged to the triple digits, the highest prices of the year so far, as a Pacific storm system was forecast to hit the Pacific Northwest to generate heavy snow and ice accumulations from Portland to Seattle. Mid-Columbia on-peak for Feb. 15 and Feb. 16 delivery boosted about $116.25 to trade at $155/MWh, and the off-peak package hiked about $113.50 to trade around $146.75/MWh.

California packages for Feb. 15 and Feb. 16 rose, with SP15 on-peak up about $117/MWh to trade around $193/MWh, and NP15 on-peak climbing $32.75 to trade around $106.75/MWh. California Independent System Operator peakload demand supported the rally in prices, with forecast demand for Feb. 15 up 1.9% to 26.7 GW.

Southwest packages saw price increments in the $200s/MWh across the board also as the weather service forecast wind chills between -10 and -25 degrees common across eastern New Mexico. Palo Verde on-peak priced around $270.25/MWh, and Four Corners on-peak traded at $314/MWh.

Northeast

Power packages in the ISO New England and NYISO were more mixed in Feb. 12 trading. Mass Hub on-peak tumbled from its recent highs to trade in the mid-$70s/MWh. Bal-of-the-week, in contrast, rose $3 to price at $87.50/MWh.

The locational marginal prices in the New York Independent System Operator were also rangebound, with Zone G adding about $2.50 to trade around $91.25/MWh and Zone J NYC falling about $7 to $94.50/MWh. The corresponding off-peak packages each rose about $5.50 to trade in the mid-$70s/MWh. Despite some of the declines, regional power prices in both ISOs remained elevated.

Unlike the rest of the country, the US Northeast is set to experience more settled weather, with high temperatures in Boston and New York City forecast to slightly increase to the low 30s on Feb. 15 with moderate chances of snow and rain, according to the weather service.

On top of everything else we are dealing with, it is likely residential and commercial power bills may be SIGNIFICANTLY more costly when February's cold snap is factored in. may even break people financially, when combined with evictions, unpaid rent, and utilities etc

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

"Power Bills To The Moon": Chaos, Shock As Electricity Prices Across US Explode

BY TYLER DURDEN

SATURDAY, FEB 13, 2021 - 15:00

On Thursday, when we reported that nat gas prices across the plains states had soared to never before seen levels as a result of a brutal polar vortex blast...

... which literally froze off nattie supply as wellheads freeze-offs, cutting production receipts just when they're most needed by customers' demand for heating, we said that since the winter blast is expected to last for the duration of the week, it is likely that nattie prices across the plains states could hit GME batshit levels.

One day later that's exactly what happened because as frigid temperatures caused equipment failures, temporarily shutdowns and flaring in at least four nat gas processing plants ...

- Targa Resources’ Benedum Gas Plant in Upton County affected for 7 hours overnight, co. said in a filing

- Occidental Petroleum’s Bennett Ranch Unit RCF Facility in Yoakum County, which is used for EOR, was affected for 9 hours Thursday: filing

- DCP Midstream’s Goldsmith Gas Plant in Ector County affected for 1 hour Thursday: filing

- Occidental’s nearby gas plant, another EOR facility, was affected by DCP Midstream incident: filing

Hubs across the Midcontinent led the surge in prices again Feb. 12 as weather forecasts predicted the coldest temperatures in more than a decade would hit the region over the upcoming holiday weekend. Platts reported that at locations across Kansas, Oklahoma and Eastern Arkansas, hub prices were trading at single-day record highs around $200 to $300/MMBtu. Regional hubs, which typically service only limited local demand, saw fierce competition among shippers, utilities and end-users looking to meet weekend requirements.

At one Enable Gas Transmission location, the cash market traded as high as $500 with weighted-average prices holding steady by mid-session around $359/MMBtu. At other nearby hubs, cash markets moved to dizzying, record highs with One Oak Oklahoma at $374 (chart above), Southern Star at $275, Panhandle at $225 and ANR Oklahoma at $205. At the region's benchmark location, NGPL Midcontinent, the market was holding around $205/MMBtu, data from the Intercontinental Exchange showed.

And as end-users across the Midcontinent compete for available gas, shippers moved quickly to cut transmissions to neighboring markets. On Feb. 12 net, inbound shipments of gas climbed to 180 MMcf/d – their highest on record dating back to 2005. In January, the Midcontinent region – which typically delivers gas to neighboring markets – saw net outbound transmissions average nearly 3.1 Bcf/d.

Of course, as natgas went offerless it was just a matter of hours before the immediate downstream commodity, electricity, would follow suit and that's precisely what happened overnight as wholesale electricity prices across all US markets on Friday.

Echoing what we said on Friday, Platts wrote that "as arctic air mass continues to blanket much of the central US, the US National Weather Service has issued multiple severe weather notices. Widespread wind chills warnings and advisories are extended through Feb. 14 and likely into the next week for much of the Upper Midwest and Midcontinent, as well as some areas in the Northwest and northern Texas. Daily temperatures across some of the locations will range between 30 to 40 degrees below average, according to the NWS. Eastern PJM, Northwest and much of Texas are also under winter storm warnings and winter weather advisories."

This is catastrophic news not only for the continued freeze in nat gas distribution, but for the explosion in electricity prices which could see many customers see a February electricity bill in the thousands, if not tens of thousands. This is what a power trader at a Houston energy company advised us on Friday:

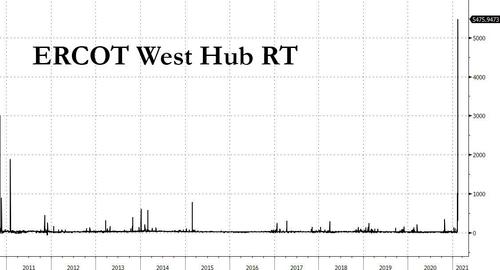

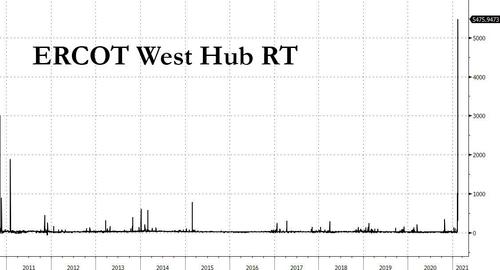

One day later, and the peak price in Ercot west real-time hit an absolute all time high of $5,500, up from $302 the day before. If anyone has a little extra nat gas in storage, this is the time to sell it and buy a private island.Prices in response to the persistent cold have pushed load expectations to all time winter highs, and on par with the hottest summer days the ISO has experienced. Actual shortages could persist if units aren't weatherized and fail at any point. Monday peak is currently bid 4000, and balweek inclusive of Tuesday through Friday is 1000@2000. Off peak (nights) have traded insane levels as well, with the balance of the month trading 650$. For reference, summer of 2018 never came close to touching these levels. The highest trade on a balday was around 2000$, if i'm not mistaken.

The PUC is meeting today to discuss coordination and potential conservation efforts, but this event will likely crush several firms who are not collateralized enough to weather (no pun intended) the storm IMO. And all those folks on griddy could literally be looking at paying 4$+ per KWh across the state (as opposed to 12 cents or whatever rate you got at your house), pushing power bills to the moon.

What follows is a breakdown of how the nat gas supply collapse is impacting soaring electricity prices across the US, courtesy of Platts:

Texas

ERCOT next-day prices reached record highs on the Intercontinental Exchange as temperatures throughout Texas were forecast to tumble double digits on Feb. 15. Dallas temperatures were forecast to drop to 8 degrees Fahrenheit, and Houston was forecast down to 34 F, according to CustomWeather.

The brutally cold temperatures also affected wind supply in ERCOT, generation for Feb. 15 was forecast to tumble down 52.5% to 27.8 GWh of generation as cold temperatures impacted wind turbines. DeAnn Walker, chairman of the Public Utility Commission of Texas, said at a meeting on Feb. 11 that there were some "issues with some gas generation plants being curtailed" and that "wind turbines are all frozen," further placing upward pressure on already sky-high prices.

ERCOT North Hub real-time next-day Feb. 15 on-peak power prices skyrocketed to trade above $3000, up from its previous settlement of $325/MWh. Next-day prices broke high records, and they had not seen similar four-digit prices since Aug. 15 2019, when prices settled around $1848/MWh.

ERCOT North Hub real-time balance-of-the-week for Feb. 16 through Feb. 19 surged to top $1500/MWh, and the balance-of-the-month off-peak package for Feb. 16 through Feb. 28 climbed about $499.75 to trade at $650/MWh.

In response to the unprecedented scramble, the Texas oil/gas regulator, the RRC, approved emergency provisions, and warning that the deep freeze may have "severe impact" on energy supplies, said that power plants may struggle to acquire gas for generators.

Central

In the Midcontinent ISO, Indiana Hub on-peak jumped to its highest price since January 2019 to trade above $100/MWh. Bal-of the-week also rallied to price on par with the next-day flow package. As polar vortex continues to impact the region, the February-to-date average day-ahead price jumped almost 70% month on month and nearly doubled year on year. MISO demand forecast for Feb. 15 is the strongest since August 2020 at 98.63 GW.

As of Feb. 12, MISO is declaring conservative operations due to extremely cold temperatures and generator fuel supply risks through Feb. 16. All transmission and generation maintenance will be suspended in the affected areas, and all outages plans should be reviewed, according to the most recent grid operator's notice.

In PJM, AD Hub on-peak traded in the upper $70/MWh, rising double digits day on day. PJM West Hub also rose to trade in the mid-$60s/MWh. Power demand was forecast to begin retreating slightly in the upcoming days, however, it was still expected to remain relatively strong.

West

West power prices surged to the triple digits, the highest prices of the year so far, as a Pacific storm system was forecast to hit the Pacific Northwest to generate heavy snow and ice accumulations from Portland to Seattle. Mid-Columbia on-peak for Feb. 15 and Feb. 16 delivery boosted about $116.25 to trade at $155/MWh, and the off-peak package hiked about $113.50 to trade around $146.75/MWh.

California packages for Feb. 15 and Feb. 16 rose, with SP15 on-peak up about $117/MWh to trade around $193/MWh, and NP15 on-peak climbing $32.75 to trade around $106.75/MWh. California Independent System Operator peakload demand supported the rally in prices, with forecast demand for Feb. 15 up 1.9% to 26.7 GW.

Southwest packages saw price increments in the $200s/MWh across the board also as the weather service forecast wind chills between -10 and -25 degrees common across eastern New Mexico. Palo Verde on-peak priced around $270.25/MWh, and Four Corners on-peak traded at $314/MWh.

Northeast

Power packages in the ISO New England and NYISO were more mixed in Feb. 12 trading. Mass Hub on-peak tumbled from its recent highs to trade in the mid-$70s/MWh. Bal-of-the-week, in contrast, rose $3 to price at $87.50/MWh.

The locational marginal prices in the New York Independent System Operator were also rangebound, with Zone G adding about $2.50 to trade around $91.25/MWh and Zone J NYC falling about $7 to $94.50/MWh. The corresponding off-peak packages each rose about $5.50 to trade in the mid-$70s/MWh. Despite some of the declines, regional power prices in both ISOs remained elevated.

Unlike the rest of the country, the US Northeast is set to experience more settled weather, with high temperatures in Boston and New York City forecast to slightly increase to the low 30s on Feb. 15 with moderate chances of snow and rain, according to the weather service.